|

_

IRS AND FTB AUDIT, COLLECTON AND APPEALS TAX HELP IRS AND FTB AUDIT, COLLECTON AND APPEALS TAX HELP

Welcome

to my website. I

recently launched a new, more user friendly (and more modern)

website:

www.dicknortontaxes.com

If you are viewing this website on a mobile

device, you definitely want to visit my new site for easier navigating.

The rest of you may also want to go there as well. Please update

your bookmarks to my new site as this site will be deactivated at some

point in the future (the URL will be pointed to the new site).

OK -

let's get down to business. First and

foremost, I am a retired IRS Associate Chief of Appeals -

offering my assistance to clients in matters of representation (audits,

collections and appeals) for IRS, FTB, and other agency tax audit

and collection actions, consultation, personal income tax preparation,

and litigation support (expert witness). I spent 34 years in

the IRS working in the collection, examination, and appeals functions.

In my experience, only a small percentage of tax professionals possess such

comprehensive inside the IRS experience.

My main office is in Santa

Clarita (aka Valencia), CA. I relocated here in 2022 after

residing in Burbank, CA for over 50 years. I meet with clients

from all of the surrounding areas - such as Glendale, Pasadena, Van

Nuys, North Hollywood, Los Angeles, and other cities within commuting

distance of Santa Clarita. However, with today's technology, I am

able to assist clients regardless of where they live and work with

representation for tax audits, collection and appeals matters - as well

as personal income tax return preparation and consultation. I even

have international clients - my furthest today being in Oman.

There is a lot of information I

am sharing here

to hopefully answer most of your questions about federal and state tax law and procedural administration and

enforcement, and what I can offer you in the way of tax help and guidance to

get you through a tax controversy with the least amount of financial

consequence and emotional stress! This is your one-stop for IRS

tax help and FTB tax help!!

As a United States Treasury licensed Enrolled

Agent (EA) and Federally Authorized Tax Practitioner (FATP), it is my objective to provide you with valuable information about my background,

my unique qualifications, and

the types of tax resolution assistance and other tax related services I offer.

I have included some important

self-help links as well as technical discussions

on important tax issues.

Regardless of your tax controversy, you can have confidence that I have

the experience and knowledge to get it

resolved. I have a network of specialists who can assist in

bankruptcy (if that is a viable option) or litigation in Tax Court or

District Court if that is necessary. Most importantly, the sooner you get help, the less complex and costly will be

the resolution of your controversy.

Please be responsive if you receive a notice

or letter from the IRS, FTB or other state tax agencies. The IRS

sends out two very serious notices -

CP504 and Letter 1058 (or its other version - Notice LT11).

These notices have specific time frames within which contact should be

made with the issuing IRS office or specific employee to preserve opportunities for appealing the proposed enforcement

action.

(This section for

my clients contains copies of newsletters, highlights of tax law changes,

and other items)

_____________________

CLICK ABOVE IMAGE TO PLAY INTRODUCTION

VIDEO

____________________

Click on the image above to visit the Blog

Tax Practice Areas

The four broad categories

of services that I offer are:

-

Individual Tax Return Preparation

-

Tax Controversy Resolution (providing

irs tax audit representation, or resolution services

relating to an IRS tax audit, collection enforcement, or

pursuing an appeal of such matters).

-

Tax-matters Consultation

-

Expert Witness

and Litigation Support

You can read more

about each service I offer by selecting the relevant menu option above.

|

Who are Enrolled Agents?

Enrolled Agents (referred to

as EAs) are the only professionals who receive their

right to practice before the IRS directly from the United States Government. Only

Enrolled Agents must prove their competence in matters of federal taxation

to the United States Treasury Department. Individual states license certified public accountants

(CPAs) and attorneys and, therefore, their licenses are state specific. Unlike

attorneys and certified public accountants, who may or may not choose to

focus on taxes, most all EAs focus their practice on tax return preparation,

and a smaller number on providing IRS and state agencies tax resolution services.

|

The

2024 filing deadline has passed. If

you have not filed your 2024 return, you should do so as soon as

possible. Failure to file is a serious matter and can

result in significant penalties and interest. We can

assist you in filing your 2024 and other delinquent tax returns.

Owe a lot of back taxes and plan to take an

international trip?

|

It's imperative to promptly address and settle

your tax obligations if you're considering

traveling outside the United States. Why the

urgency? Well, the IRS has been actively

communicating with the State Department,

prompting them to take action such as denying

the issuance of new passports or renewals, or

even revoking existing passports for taxpayers

with outstanding tax liabilities exceeding

$62,000 in tax, penalties, and interest, among other criteria. Booking a trip

abroad only to encounter the unpleasant surprise

of being unable to leave the U.S. due to a

revoked passport or inability to get a new one

is a scenario best avoided at all costs!

|

|

|

Be alert to fraudulent

contacts by scammers pretending to be IRS employees!

Thousands of taxpayers suffer financial loss and

identity theft monthly when they provide personal and

financial information or make payments to fraudsters!! Most of these crooks use scare

tactics (like - there is a warrant for your arrest, or

they are going to levy (attach) your accounts or salary)

if you do not pay immediately! They often demand payment

by an unconventional method - such as by gift cards or a Western

Union transfer.

Almost always, the IRS's first

taxpayer contact will by letter or notice of a pending

audit or non-payment of a liability. If you have

never received such a letter or notice, then be very

skeptical about an unexpected call allegedly from the IRS!

Bottom line - if you are surprised by a

call from someone alleging to be from the IRS, get their

name, employee number, title of their position, their office address,

and their contact phone number - then tell them you will

call them back after you have verified their information.

You can then call the IRS at (800) 829-1040 and the employee

can confirm whether or not you should have received the call

and verify the employee information. If you cannot get

through to the IRS, then you can call me with the

information and I will check it out through my sources.

|

NOTE - You will need the access code to download one

of the organizers - contact me if you forgot it!

There are only

left until the 2025 return filing deadline!

Communicating with the IRS or State

Tax Agency Employees

Taxpayers need to exercise care in deciding

whether or not to personally talk with IRS or state tax agency employees. In the worst case

scenario, making the wrong statement could

turn what should have been a civil resolution into potentially a criminal

tax matter. IRS Agents are well trained to look for "badges of fraud" in

their audits. Always be truthful in your statements to IRS or state

employees. An intentional false statement or providing fabricated

documents can land you in very hot

water!

|

Should you handle your own controversy

or audit?

|

Navigating the IRS and state tax

resolution process can be daunting. To

handle it alone, a taxpayer would need

to invest extensive time learning the

intricacies of the Internal Revenue

Code, IRS regulations, case law,

official rulings, procedures, and the

Internal Revenue Manual (IRM) that

governs IRS processes. Additionally,

developing a strong command of tax

strategies to negotiate favorable

resolutions is essential.

Without

this level of preparation, taxpayers are

far more likely to face less favorable

outcomes. In fact, the potential

financial impact of self-representation

often outweighs the cost of hiring a tax

resolution specialist, typically an

enrolled agent or CPA, who has the

knowledge to achieve better results.

It’s important to recognize that not all

accountants, attorneys, or enrolled

agents specialize in tax resolution.

This field requires specific expertise.

Therefore, if you are currently facing,

or might soon face, a tax dispute with

the IRS or a state tax agency, engaging

a tax resolution specialist is crucial.

|

When Do You Need Professional Help?

While I generally do

not recommend any taxpayer take on the IRS or a State tax agency on

their own, I am very sensitive to clients with financial challenges and

may be able to suggest ways for them to get IRS tax help and guidance

while reducing their out-of-pocket costs for

tax resolution help. If you feel capable and comfortable with working over the telephone, fax

or mail (or, in rare circumstances - face-to-face) with an

IRS Revenue Officer, IRS Revenue Agent, IRS Tax Compliance Officer (TCO),

IRS Appeals Officer or IRS Settlement Officer, or any other employee

involved in your IRS or California tax audit or collection controversy, then retaining me to hold your hand (which

means that I will be providing you with an

explanation of your options, strategic guidance, review of documents, and

specific suggestions) could

make the difference between the success or failure of your tax resolution efforts!

|

Time if of the essence in dealing with tax issues

|

|

An important note about tax

liabilities

Tax liabilities are almost always

secured debts. A

federal lien arises after demand and non-payment of tax,

including interest, additions to tax, and assessable penalties

(§ 6321 Internal Revenue Code). The lien is affixed at the time the assessment is made

and continues until it is satisfied or becomes unenforceable (§

6322). The lien is not perfected against certain creditors until

public notice is given (§ 6323), but timing of the secured interest still

arises at assessment.

Issues surrounding the priority of liens and competing claims

can be complicated, and advice and/or assistance from an

attorney may be needed.

The services I provide concerning the resolution of liabilities

relate solely to secured tax debts, and all references on

this website related to resolution of Federal or State

liabilities relate to secured tax liabilities.

If you have unsecured debts, such as credit cards or personal

loans, help is available from numerous

attorneys or specialized debt-resolution companies to address

those types of liabilities.

|

Do your homework before selecting a firm to represent you!

I

strongly recommend that you check out any individual or firm BEFORE you

commit to having them represent you. Remember that it is

your life - and your liability!

You can delegate the authority to have someone represent you. But,

all tax agencies will hold you

solely responsible for your tax

liability. Accordingly, you owe

it to yourself to do some checking before retaining the services of a tax resolution

specialist. The Better Business Bureau and Business Consumer

Alliance are two such references. Links to my A+ reviews are at the

bottom of this page.

|

What About an Offer In Compromise (Settling your debt for less than the

face amount)?

There are a slew of media ads on this

topic. Substantial concessions of tax, penalties, and interest by the IRS and state

agencies generally require extenuating circumstances - such as serious

medical issues, advanced age, or actual or projected long-term unemployment by unskilled

individuals. I was the approving official at the IRS for offer in

compromise (OIC) cases in

my jurisdiction for almost two decades, so I have a solid understanding of what is

required to have an offer seriously considered and approved. Your

consultation with me concerning your potential qualification for an OIC

is free. See the consultation page for more information.

|

My Prior IRS

Experience

I retired as the

Associate Chief of the Los Angeles, California IRS Appeals Office

following many years of managerial and technical positions in

the IRS Appeals, IRS Examination and IRS Collection functions. There

are a limited number of other practitioners

who possess such experience. As evidence of my success and recognition while working for the IRS, I was

honored to receive the National Appeals Manager of the Year award before

retirement.

As you would

expect, my

extensive knowledge of IRS policies, procedures and practices has proven

invaluable in helping me to resolve my clients' tax

issues. In fact, I often provide guidance or services to other tax professionals who

are facing challenging technical or procedural issues for their clients.

|

Tax Topics

Do you want to know more

about the new rules for employee unreimbursed business expenses?

Are you interested in finding out if you would qualify for an Offer in

Compromise? Do you believe that you may be an "innocent spouse" and

therefore, not liable for a portion of a joint deficiency with your ex-spouse?

What are the rules for paying the "nanny tax?" Do you have some other tax

question for which you need further information?

There is a large section of

this web site devoted to addressing these and many other recurring tax issues of

interest to most individual taxpayers. In addition to the above

items, topics addressed include Collection Due Process procedures, installment

agreements, contributions of property (you most likely have heard all of the

radio ads advertising large deductions for donating your car that needs repair

and cannot be sold ... be careful on this one!!.) - and the list goes on.

If you are interested in reviewing the index of topics, click

the Tax Topics button on the index bar.

|

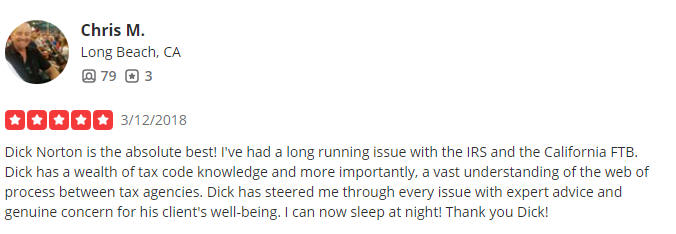

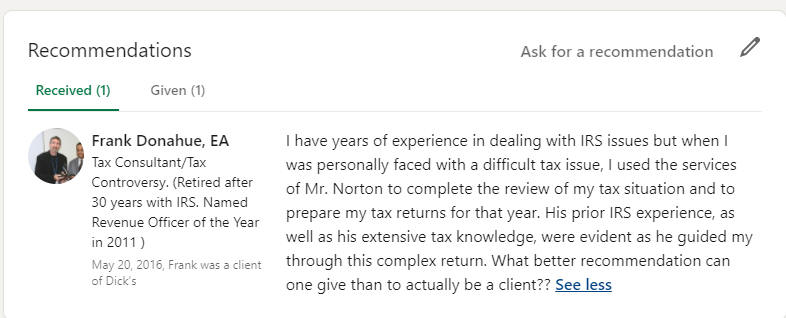

Assuming you are not a referral from

one of my current or former clients, it can be reassuring to hear from

former clients. Below are several client reviews that are on Yelp and

Linkedin that

I will share with you. I encourage you to check out the BBB and other sites

which should help you have confidence in my ability to address and resolve your

tax related issues.

Dick

Norton, EA, FATP

Tax Resolution Specialist

|

Nothing on this website

is intended to be specific tax advice for you, the reader, and cannot be

relied upon for the purpose of avoiding any penalty that may be imposed

by the IRS or any tax agency. The material on this and all

other pages of this website is provided for informational and

educational purposes only. I

do not

guarantee or warrantee in any manner the suitability, usefulness,

accuracy, timeliness, or results of any portion of this site, nor the

links contained in this site which link to other areas. At times,

information is taken from other sources and is believed to be accurate,

but no verification or confirmation is performed. Tax law is a very complex subject.

Any tax opinion upon which you may rely requires the careful and

thorough analysis by a tax professional of the specific facts of your situation and the

applicable legal statutes. If you need specific advice, then you should

request formal tax consultation as its purpose is to provide you with guidance for your

specific tax issue or question upon which you can rely. |

|